The highs and lows of IR35

This week the outcome of two high profile cases concerning IR35 hit the news - one won by HMRC and one lost, here's what you need to know.

In the past couple of weeks, we have seen the outcome of two high profile cases concerning IR35 hit the news - one won by HMRC and one lost.

Last week we saw one of the most high-profile defeats for HMRC to date regarding the IR35 legislation as Gary Lineker won his battle over a £4.9 million tax bill. In this case, HMRC had asserted that Gary Lineker was an employee of both BBC and BT Sport, but the Tribunal held that he was a genuine freelancer, who operated via a partnership, and that the IR35 legislation did not apply to Lineker.

IR35 is a complex matter, and HMRC’s view of an individual’s employment status is only their view and they do not hold a monopoly on wisdom. The fact that they lost this case (subject to any appeal of course) demonstrates that they are not always right.

On the other side of the coin, HMRC had a better result only a few days after the Lineker news emerged – winning the appeal that TV presenter Eamonn Holmes had brought against the first-tier Tribunal’s finding that IR35 applied to his work for ITV.

Holmes had operated via his limited company in providing his services to ITV and has argued throughout this litigation that he was an independent contractor in business on his own account, and that he was not subject to ITV's instructions or in receipt of any employee benefits. The first and now Upper-tier Tribunals concluded that whilst the contract between his limited company and ITV purported to show he had independence, it would have been "career suicide" for him to disagree with ITV decisions and that in reality, ITV exercised control over him.

Holmes now faces a substantial tax bill, but it is important to remember that cases such as this one were commenced before the 2021 change in the IR35 system. It is likely nowadays that ITV would be the ones pursued by HMRC, rather than the individual contractor, and it is for that reason that end-users of contractors need to be very clear on their legal position and the options available to them.

So, once again, the complexities of IR35 and issues of employment status rear their head. For advice on these complicated matters, contact our Employment Team - who specialise on advising on IR35 matters and the disputes that arise from them - at Leathes Prior via hgill@leathesprior.co.uk or call 01603 610911.

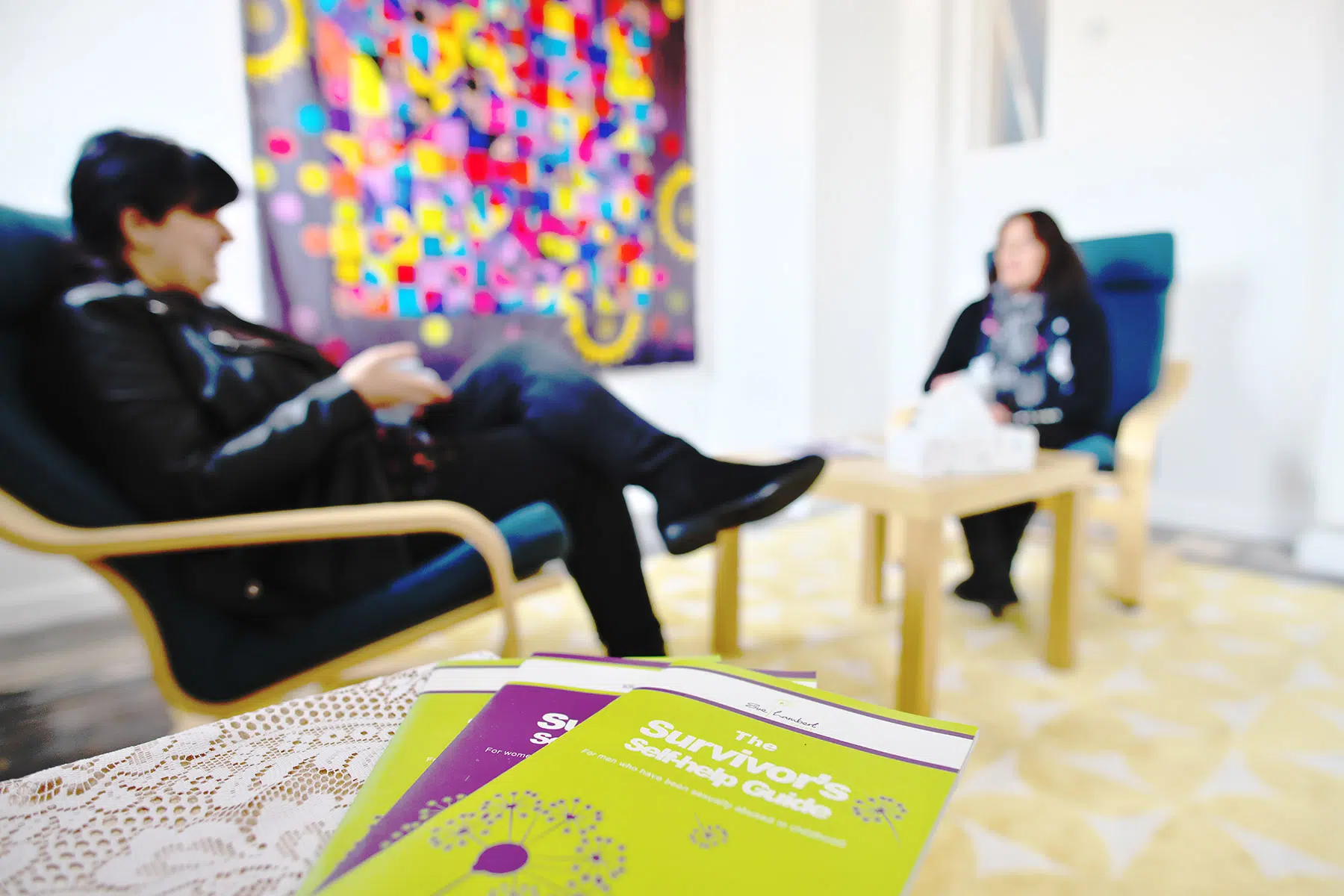

Charity of the Month: Sue Lambert Trust

Leathes Prior is delighted to be supporting the Sue Lambert Trust as our Charity of the Month for February 2026. Sue Lambert Trust is a leading charity in Norfolk offering free therapeutic counselling and support services to survivors of sexual violence and abuse.

Supreme Court ruling set to impact NHS - Children injured by NHS can claim damages for lifetime lost earnings

In February 2026, the Supreme Court passed a ruling which is set to significantly increase the amount of damages the NHS may have to pay for claims brought in respect of children injured at birth, as a result of medical negligence.

.jpg)

The Value of Planning Ahead: LPAs & Court of Protection

Putting LPAs in place allows you to choose trusted people to make decisions for you if you lose capacity in the future. This avoids the need for loved ones to make a costly and time-consuming deputyship application to the Court of Protection. With more people likely to experience conditions affecting capacity, more families may need to turn to the Court for support where no LPAs are in place.

.jpg)