The Future of EOTs: Less Tax Relief, Still Strong Potential

Hugo Persad, Trainee Solicitor in our Corporate Team, summarises the impact of reduced Capital Gains Tax (“CGT”) relief on sales to Employee Ownership Trusts (“EOTs”) following the Autumn Budget.

The Autumn Budget on 26 November 2025 introduced a number of new considerations for business owners. A major and unexpected change was the reduced Capital Gains Tax (“CGT”) relief on sales to Employee Ownership Trusts (“EOTs”).

Since the introduction of EOTs over a decade ago through the Finance Act 2014, EOTs have become an attractive route for business owners seeking to exit and also considering succession planning. One desirable appeal of EOTs was the 100% relief on CGT making it a beneficial and tax-efficient mechanism for an exit strategy. This made EOTs a desirable option for business owners who wanted to take a step back while also ensuring their business preserves its independence, culture, direction and allows for the business to remain in trusted hands.

While the Autumn Budget reduced the CGT relief available, it did not affect the core principles of selling to an EOT, and it is worth remembering that an EOT may still be a viable option for exit. A sale to an EOT can be significantly more streamlined than a traditional sale to a third party and there may still be many other commercial factors that could make an EOT the right fit. Likewise, there are instances where an EOT will not be appropriate. EOTs are still relatively tax efficient, so while the CGT relief is reduced, business owners will still benefit from an overall lower rate in comparison to that applicable on a third-party sale.

The sale to an EOT is still an attractive option for owners looking to make an exit, albeit the tax landscape is now slightly more equal. Importantly, it is not the only viable option. Business owners still have a range of exit strategies available to them each offering different advantages depending on their objectives, financial position and desired legacy.

To understand more about Employee Ownership Trust, or other exit strategies for your business going forward, please contact our Corporate Team by email at info@leathesprior.co.uk or by telephone at 01603 610911.

.jpg)

Spring Statement 2026 - An Overview

With the Government having restricted itself to one fiscal event a year in the form of the Autumn Budget, the Spring Statement is perhaps not the dramatic moment it used to be. It is more a chance for the Government to respond to events and economic forecasts than to set policy for the future.

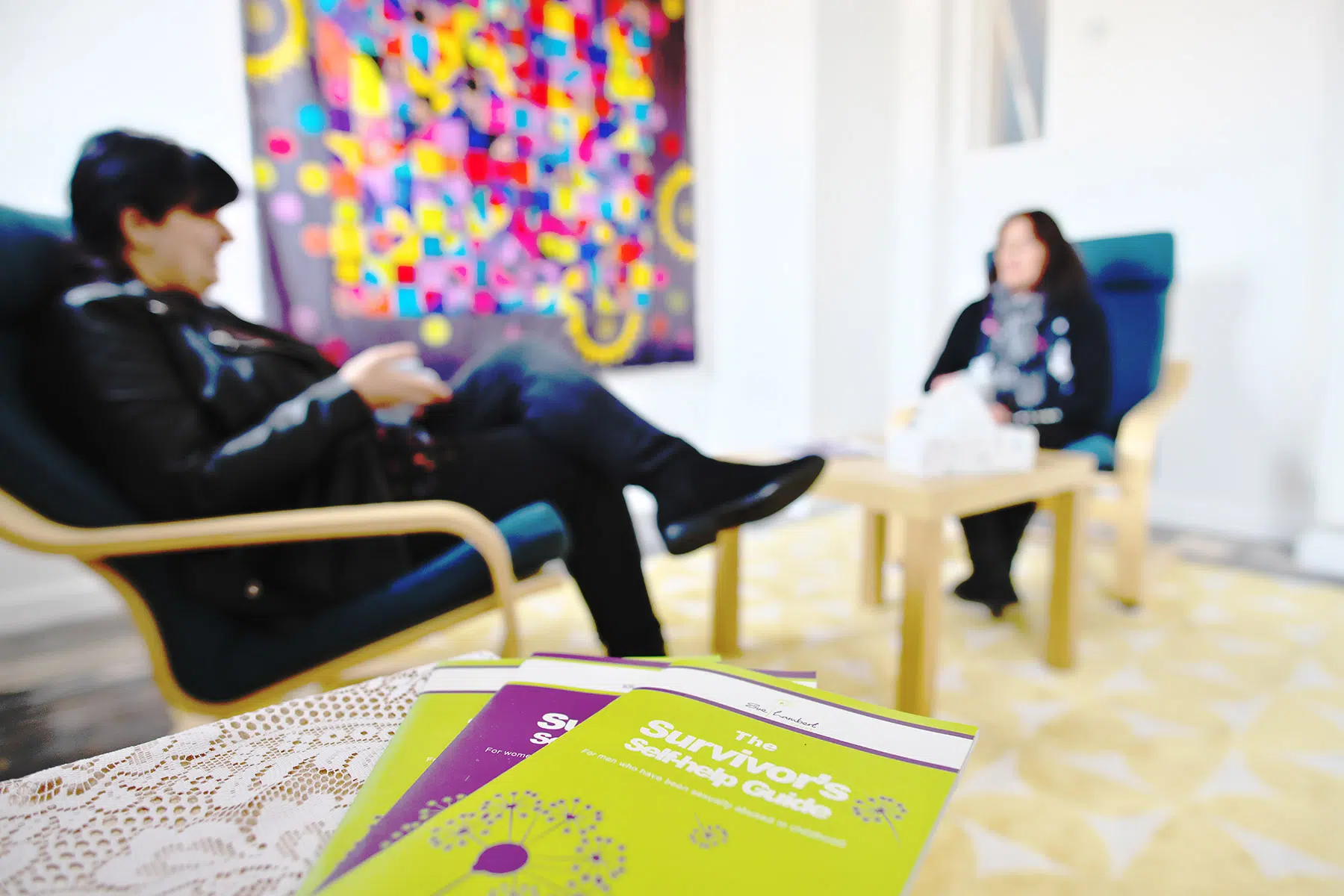

Charity of the Month: Sue Lambert Trust

Leathes Prior is delighted to be supporting the Sue Lambert Trust as our Charity of the Month for February 2026. Sue Lambert Trust is a leading charity in Norfolk offering free therapeutic counselling and support services to survivors of sexual violence and abuse.

Supreme Court ruling set to impact NHS - Children injured by NHS can claim damages for lifetime lost earnings

In February 2026, the Supreme Court passed a ruling which is set to significantly increase the amount of damages the NHS may have to pay for claims brought in respect of children injured at birth, as a result of medical negligence.

.jpg)

The Value of Planning Ahead: LPAs & Court of Protection

Putting LPAs in place allows you to choose trusted people to make decisions for you if you lose capacity in the future. This avoids the need for loved ones to make a costly and time-consuming deputyship application to the Court of Protection. With more people likely to experience conditions affecting capacity, more families may need to turn to the Court for support where no LPAs are in place.

.jpg)