Farming Partnership Problems - needn’t be normal for Norfolk

Many family-run farms across rural Norfolk and the rest of the UK are currently operating their business as a partnership for the simple reason that they satisfy the definition of a partnership: they are “carrying on a business in common with a view to making a profit”.

Many family-run farms across rural Norfolk and the rest of the UK are currently operating their business as a partnership for the simple reason that they satisfy the definition of a partnership: they are “carrying on a business in common with a view to making a profit”. There is no requirement for a formal partnership agreement to be in place, and in the absence of such, the relationship will automatically be governed by the Partnership Act 1890.

Many farms have operated in this manner for several generations without a formal partnership agreement. However, for the reasons we set out below, this is potentially a very risky strategy that could put the future of the farm at risk in the wrong set of circumstances.

Although the Partnership Act attempts to govern all partnership relationships, given the inherent differences between partnerships, it naturally cannot do so. This is particularly the case for family-run farms, where the intention is to pass the farm from generation to generation. One particular example of a situation in which the Partnership Act would not be suitable for a family-run farm is the death of a partner.

Under the Partnership Act, the partnership automatically dissolves on the death of a partner, unless the partners have agreed otherwise. In these circumstances, the remaining partners have authority to carry on business only for the purpose of winding it up. Here, the deceased’s share of the capital at the date of death becomes owing to the deceased partner’s estate as a debt. However, the deceased’s estate must also bear the share of any loss if the business is loss-making. Under the Partnership Act, the deceased estate has an option to require either:

(a) share in the profits attributable to the capital or

(b) interest on the capital, from the date of death until final settlement.

It may be the case that this will not have any detrimental effect on the farm. For example, if the beneficiaries of the deceased’s estate either already work on the farm, or have no desire to liquidate the assets they are entitled to (as referred to below), business will be able to carry on as normal and a new partnership will be formed.

However, in certain circumstances, the death of a partner in a partnership which is not governed by formal agreement could be catastrophic for the future of the farm. Under the Partnership Act, the personal representatives of the deceased partner can require the partnership to be wound up and all assets sold. As such, a personal representative could decide that they wish to realise the value of the assets to which the beneficiaries are entitled. Whilst there is rarely the appetite to do so, in the context of a farm, this can be an especially problematic issue given that a partner’s share of the capital in a farm may be a share in a significant amount of land. Further complications may arise as, if the personal representative leaves the deceased partner’s interest in the business for a time, the personal representative will, by virtue of law, become a partner and therefore personally liable for the liabilities of the partnership.

On the basis that the personal representative would be entitled to liquidate that land to realise its value, the farm has two options. The first is to realise the beneficiaries’ share in the land using other assets, such as cash. However, due to the large amount of land that is often owned, and the high value of cash that would be needed, this is often impossible. Therefore, the surviving partners may be forced into the second option, which is to sell the share of the land to which the beneficiary is entitled. Of course, land is vital to any farm’s business so selling a portion of it is far from ideal.

We hope this example clarifies the scope of the potential problems that can arise from a farm being run without a formal partnership agreement in place. By implementing a partnership agreement, the partners are able to exclude the provisions of the Partnership Act which dissolve the partnership on the death of a partner. Therefore, provision can be made to ensure that a deceased partner’s estate is not entitled to his share in the capital, and can thereby eliminate the subsequent problems that may arise. A partnership agreement can also be a useful document in a number of other areas, for example: clarifying how disputes are resolved, procedures on retirement of a partner and how meetings should be conducted.

If you have any questions regarding the issues raised in this article, please contact Darren Bowen, Head of our Property Disputes Team, Sarah Ellero in our Commercial Property Team or a member of our Corporate and Commercial Team.

.jpg)

Spring Statement 2026 - An Overview

With the Government having restricted itself to one fiscal event a year in the form of the Autumn Budget, the Spring Statement is perhaps not the dramatic moment it used to be. It is more a chance for the Government to respond to events and economic forecasts than to set policy for the future.

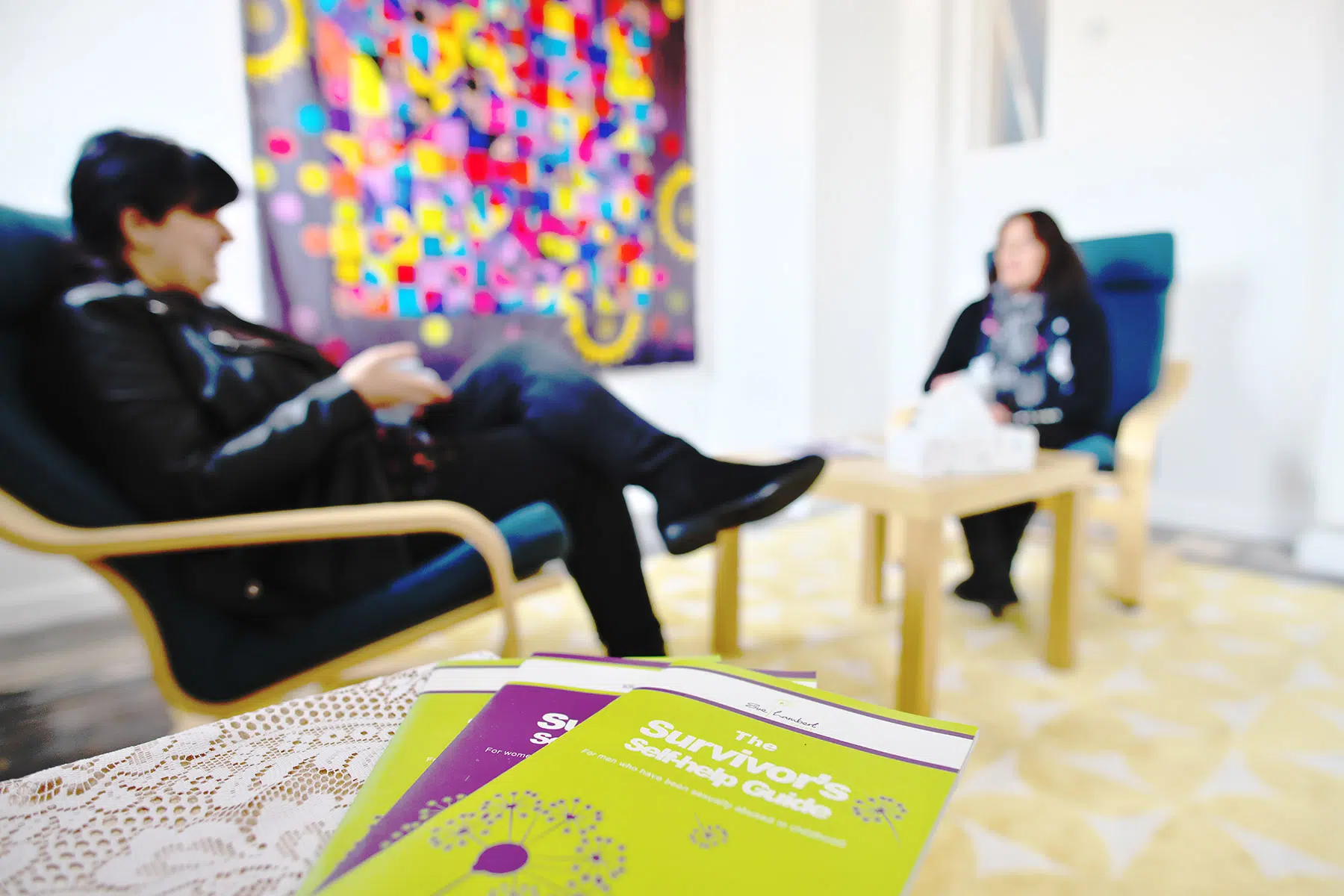

Charity of the Month: Sue Lambert Trust

Leathes Prior is delighted to be supporting the Sue Lambert Trust as our Charity of the Month for February 2026. Sue Lambert Trust is a leading charity in Norfolk offering free therapeutic counselling and support services to survivors of sexual violence and abuse.

Supreme Court ruling set to impact NHS - Children injured by NHS can claim damages for lifetime lost earnings

In February 2026, the Supreme Court passed a ruling which is set to significantly increase the amount of damages the NHS may have to pay for claims brought in respect of children injured at birth, as a result of medical negligence.

.jpg)

The Value of Planning Ahead: LPAs & Court of Protection

Putting LPAs in place allows you to choose trusted people to make decisions for you if you lose capacity in the future. This avoids the need for loved ones to make a costly and time-consuming deputyship application to the Court of Protection. With more people likely to experience conditions affecting capacity, more families may need to turn to the Court for support where no LPAs are in place.

.jpg)