Is your business ready for the new law regarding payment of tips to staff?

On 1 July 2024, the Employment (Allocation of Tips) Act 2023 comes into force, requiring businesses to allocate and distribute all qualifying tips, gratuities, and service charges to their workers in a fair and transparent way.

Overview of new law around paying tips

On 1 July 2024, the Employment (Allocation of Tips) Act 2023 comes into force.

This law requires businesses to allocate and distribute all qualifying tips, gratuities, and service charges to their workers in a fair and transparent way. It applies to any business that receives a qualifying tip from a customer, so whilst it will particularly affect businesses in the hospitality industry (hotels, restaurants, coffee shops, and bars) it will also impact hairdressers, taxi companies, and other such businesses that regularly receive tips.

The law also sets out that tips must be distributed by the end of the month after the month in which the tip was paid, and that you have to keep a record of how every tip has been dealt with.

This new legislation is complex, and also given it will not impact the majority of businesses who do not regularly receive tips, we are not going to set out chapter and verse in this article. Instead, we have prepared a detailed briefing note, and if you would like to receive a free copy of our briefing note please contact our Employment team by emailing Eleanor Disney via edisney@leathesprior.co.uk and we will send this to you.

If your business receives tips on more than an occasional or exceptional basis, the new law provides that you must have a written policy detailing how you will deal with tips. Leathes Prior has already begun assisting businesses with drafting their own bespoke tipping policy and advising on the necessary legal issues arising. If your business would like to instruct us to prepare a policy for you, or you would like a quotation for such, please also contact us as set out above.

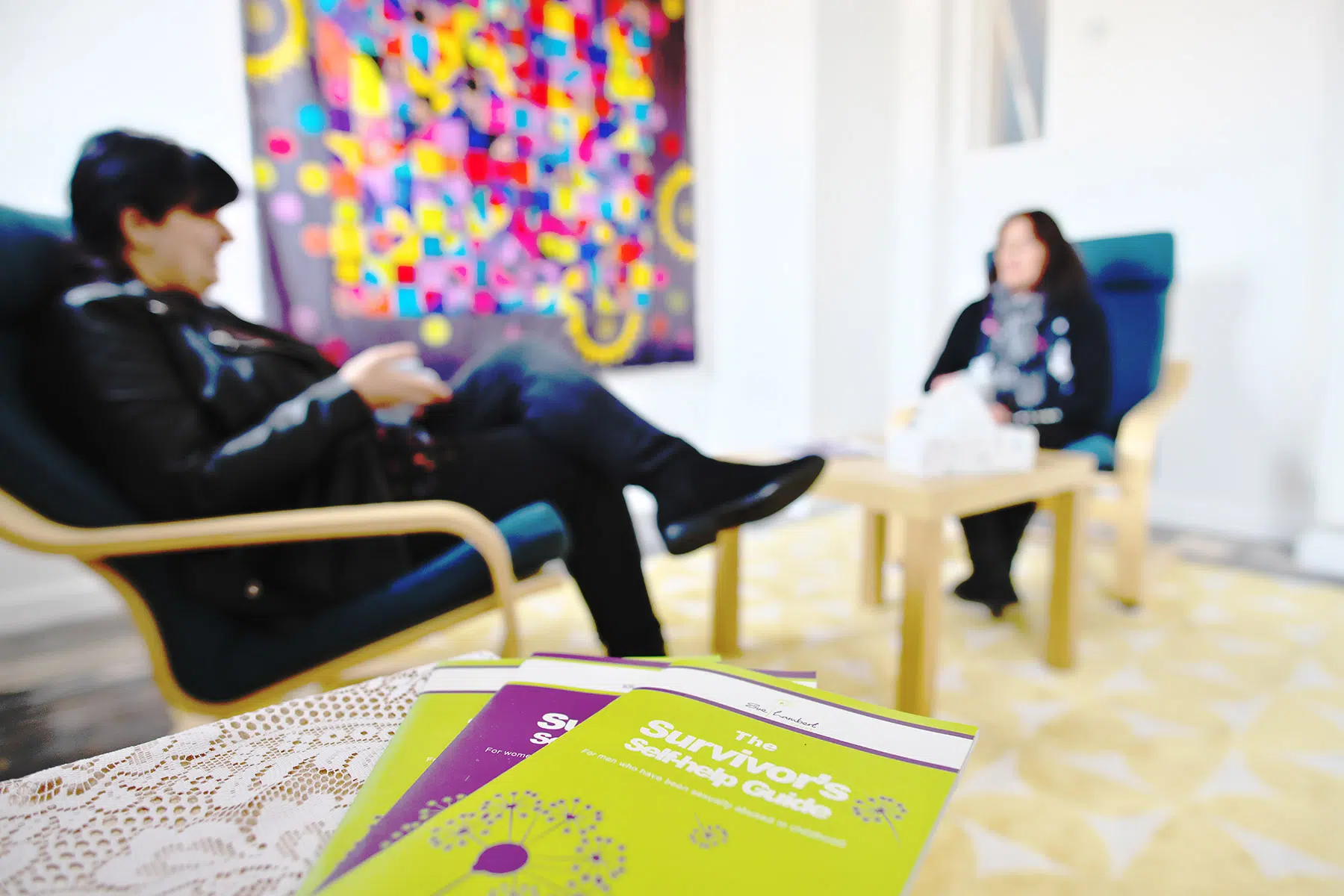

Charity of the Month: Sue Lambert Trust

Leathes Prior is delighted to be supporting the Sue Lambert Trust as our Charity of the Month for February 2026. Sue Lambert Trust is a leading charity in Norfolk offering free therapeutic counselling and support services to survivors of sexual violence and abuse.

Supreme Court ruling set to impact NHS - Children injured by NHS can claim damages for lifetime lost earnings

In February 2026, the Supreme Court passed a ruling which is set to significantly increase the amount of damages the NHS may have to pay for claims brought in respect of children injured at birth, as a result of medical negligence.

.jpg)

The Value of Planning Ahead: LPAs & Court of Protection

Putting LPAs in place allows you to choose trusted people to make decisions for you if you lose capacity in the future. This avoids the need for loved ones to make a costly and time-consuming deputyship application to the Court of Protection. With more people likely to experience conditions affecting capacity, more families may need to turn to the Court for support where no LPAs are in place.

.jpg)